Atomic has the goal of being the first 100-year-old software consultancy. In a business environment where software consultancies are succumbing to the ebb and flow of industry demand, this is an ambitious goal. As innovation in the custom software industry has become a competitive advantage for big business, many software consultancies have been acquired for moderate sums of money. It seems like the journey to 100 years may be both harrowing and fool-hardy.

So why would we as an organization stretch toward this goal? There must be something of worth within Atomic to go to the effort of being around for that long.

The answer lies in the fact that we see our organization being accountable to more than our bottom line. We are more than a money-making machine.

A Triple Bottom Line?

Many companies refer to this style of accountability as a “triple bottom line”. Instead of just letting a profit & loss statement (traditional bottom line) be the measure of performance, they choose to evaluate on more than economic factors. They take into account their social and environmental performance in addition to their financials.

Some indicators of social performance could be charitable contributions, employee welfare and engaging in fair trade practices. Indicators of environment tend to be measurements of resource consumption, land use and waste management.

Atomic’s Quadruple Bottom Line

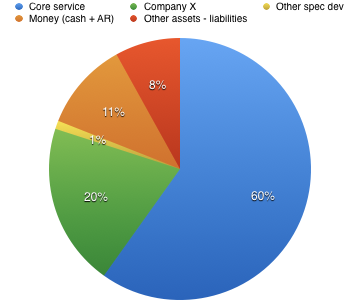

At Atomic, we have a quadruple bottom line. We’re overachievers to the end! We refer to these areas of accountability as our “four buckets of good”. The buckets are: People, Profit, Product, and Place.

- People – Our most valuable resource are Atoms, the people who work at Atomic. We invest heavily in their professional development every year.

- Product – Atomic’s brand promise to our clients is an awesome product (the work we do for them) and an awesome experience (their involvement with our teams should be wildly positive).

- Profit – We care deeply about our financial performance. Without solid financial performance, we would be dead in the water very quickly. Much of what we do in all the other buckets flows from this bucket.

- Place – As a business, we want to make a positive impact in the places we live and work. We want the urban areas we choose to place our offices in to be noticeably improved as a result of hosting us.

We want the good we do as a business to fill up these figurative buckets. They are, in effect, our most important stakeholders. To bring this full-circle—the good we do by filling these buckets represents the moral underpinning of our goal to be the first 100-year-old software consultancy. We believe this engine of good in the universe deserves to be around for at least 100 years.

Enter Agency Theory

As a for-profit business, Atomic stands in stark contrast to alternatives in corporate America. In the present day, why do for-profit businesses exist? The reason is kinda in the name, right? They are “for profit”. This is, in fact, an interesting idea popularized in the 1970s called “agency theory”. This idea became so popular that it guides operational decisions at a majority of publicly traded companies today.

Agency theory is the idea that the only success factor in business is the bottom line. How do you know if you were successful in a given quarter? Look at the bottom line of your profit & loss statement. Is there a positive number down there? Then you did good.

In this scenario, there is only one stakeholder in business–the shareholder. Executives work as agents of the shareholders, thus the name “agency theory”. Executive decisions are judged by whether or not the results fall in line with shareholders perceived best interests.

Increasingly, corporate shareholder boards have used stock options to more closely align executive priorities with shareholder priorities. Shareholders’ top priority in this arrangement is to maximize shareholder return quarter over quarter.

The Dangers of Agency Theory

Although agency theory seems to make sense for a for-profit organization, it has some unhealthy underpinnings.

1. Disengagement from the community

First of all, it assumes that a corporation operates in a vacuum. There is an intimate entanglement between any business and its community. The business provides wealth, goods, and services to the community. In turn, the community provides consumers, employees, facilities, and possibly raw materials. To say that this relationship doesn’t necessitate some responsibility between the two parties is to ignore a fundamental part of what it is to be in business.

Shouldn’t a corporation seek the best health of the community in which it exists to ensure the long-term health of the organization? If a business cuts off all inputs in an effort to eliminate responsibility with the surrounding world, it will wither and die. If it indiscriminately pollutes the surrounding world, eventually there won’t be anything to keep it in business.

2. Focus on expectation markets

Agency theory has also oriented business success factors away from “real” markets to “expectation” markets. Publicly-traded companies performance is monitored by the stock market on a quarterly basis through a quarterly earnings call. The content of this call gives investors and investment reporters an indication of how the company has performed relative to investor expectations. If the company is judged to have performed well by maximizing shareholder return, more investors will buy stock in the organization. If the company fails to maximize shareholder return according to expectation, the company is underperforming and runs the risk of investor sell-off, which devalues the organization.

This re-orientation of attention from the “real” market to an “expectation” market is, by far, the most damaging effect of agency theory. In Roger Martin’s book “Fixing the Game”, the author likens this phenomena to a breakdown in the separation between active competitors in the NFL and the gambling market. Imagine if the coach of your favorite NFL team wasn’t focused on preparing the team to win games, but instead focused on getting the team to perform according to the expectations of a majority of bettors. Would you have faith in the efforts of your team? They would no longer be focused on the “real” market of playing to win the game. They would be focused on the “expectation” market gamblers created. In corporate America, attention has pivoted from competing in the real market of consumers and is focused on competing in the expectation market of stocks.

3. Short-term thinking

Additionally, the prevalence of agency theory has led to a shortened time window in which business practice is evaluated. Quarterly earning calls drive share prices in the stock market. If a business is forced to operate in a three-month time window, it is highly unlikely it will innovate. Innovation’s payoff isn’t short term. The iPhone, probably the single biggest technological innovation in the last 25 years, took a decade to conceive and build. How many products were conceived internally at Apple and thrown away in those ten years? Research and development isn’t cheap, isn’t efficient, and it isn’t profitable. The return on the investment you make in innovation isn’t certain.

Be Different

There is a widening divide in business between those following the whims of the expectation market and those who have their pulse on the real market. At Atomic, our passion is to serve the real market in a way that makes a lasting impact. Although we deeply care about the financial well-being of our organization, it isn’t our only priority. We hope that this practice will improve our chances of being around for 100 years.

The post Why should Atomic exist for 100 years? appeared first on Great Not Big.